To say finance and budgeting are critical to the functioning of an organization is an understatement. No enterprise runs without the ebb and flow of money—and the strategy, data management, analysis, scaling, and ROI that comes along with it. Unnecessary setbacks, like manual processes and avoidable human error, negate and undermine calculated risk evaluation, automation, and a touch of modernity.

Like any other department within an organization, finance has and can run on spreadsheets and paperwork; but in doing so, what advantageous avenues are we missing out on?

Without proper automated finance workflows and the adoption of business process management (BPM) platforms, businesses struggle to keep up with the demands of the industry.

Inefficient manual processes can lead to errors, delays, and increased costs—ultimately hindering growth and profitability. By embracing automation and process management technology, businesses can streamline their finance operations, improve accuracy and efficiency, reduce risk, and ultimately drive better business outcomes.

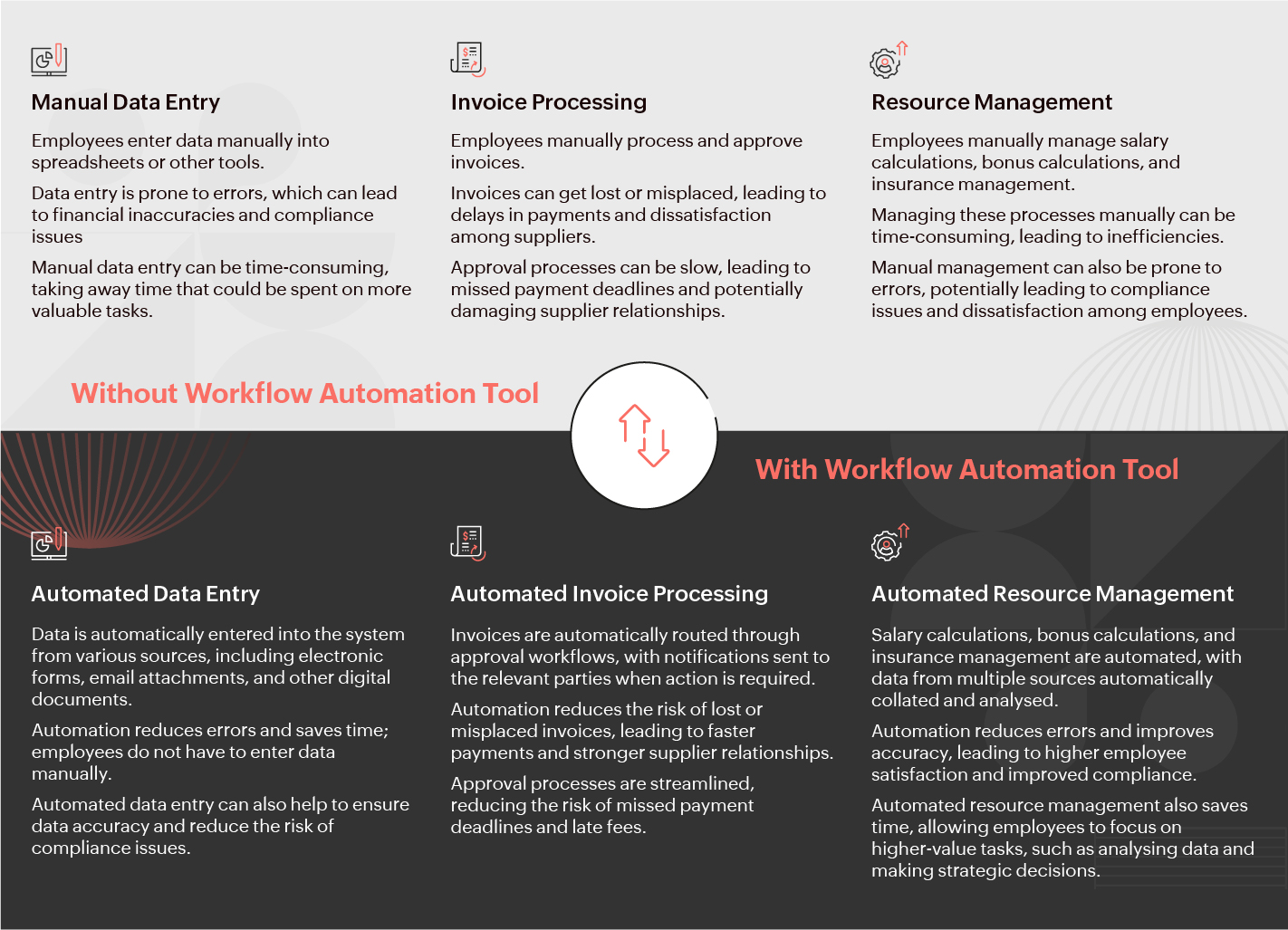

Automated vs manual technical finance flowcharts

Here's a side-by-side comparison of finance department workflows with and without an automation tool, along with an in-depth look at the implementation process and benefits of workflow automation:

Finance departments need clearly defined processes and procedures to ensure accuracy and efficiency in their operations. Even though some are prone to the risk of data loss - no digital footprint to backtrack human errors. Each step should be streamlined and integrated into a single system, from recording transactions to financial reporting and analysis.

Why your company needs agile automation for improved workflows

Finance leaders plan to increase investment in automation in the coming years, as companies recognize its potential to streamline processes, reduce errors, and improve decision-making.

For example, automating accounts payable processes can reduce the cost of invoice processing by a significant amount, according to aGartner study. This translates into faster payments and improved vendor relationships.

And this is not to mention the diverse avenues for payment in today's business world, not just regarding local transactions but for businesses that have to accommodate international transactions for e-commerce, SAAS, and trade.

It's now the bare minimum to facilitate tools for smoother and faster closers, and manual paper trails just can't keep up with growing organizations.

A BPM can also improve cash flow forecasting and working capital management. For example, using integrated analytical tools, accessible, recorded data, and input from market trends can help finance teams make more accurate and informed decisions about cash management.

You can even improve compliance and reduce risk with automation. For example, automating financial reporting processes can ensure accuracy and reduce the risk of non-compliance with regulatory requirements.

Automation can also improve customer experience. For example, automating billing processes can reduce errors and improve the speed and accuracy of invoices, which can result in higher customer satisfaction.

Key pain points addressed by automating finance department workflows

- Automating accounts payable (AP) and accounts receivable (AR) processes can speed up invoice processing, reduce errors, and improve cash flow management, by eliminating manual data entry and improving accuracy.

- Automated reconciliation software can save time and reduce errors by matching transactions more quickly and ensuring accurate bookkeeping.

- Automating financial reporting generates reports more quickly and accurately, providing businesses with better insights into their financial performance and helping them make more informed decisions.

- Automated finance workflows can help businesses ensure compliance with financial regulations and standards, reducing the risk of errors and improving regulatory compliance.

- Collaboration can be improved through automated finance workflows, enabling easier financial data sharing, reducing errors, and improving communication.

- Automating finance department workflows can reduce errors, increase efficiency, and improve financial performance, freeing up valuable resources and providing better insights into financial data.

Drawbacks for finance departments without automation

- Tedious and time-consuming manual data entry and reporting, leading to potential errors and delays.

- Inefficient use of resources due to manual processing, leading to higher costs and lower productivity.

- Difficulty tracking and monitoring financial activities leads to increased risk of fraud and non-compliance—and the inability to provide timely and accurate financial information to decision-makers—leading to poor strategic decisions.

By implementing automation software and business process automation, finance departments can significantly improve their workflows and overcome these drawbacks.

Learn how you can implement workflow automation in your processes

The benefits of using automation platforms include

- Reduced manual data entry and processing time, leading to improved accuracy and faster decision-making.

- Improved resource utilization, leading to cost savings and increased productivity.

- Increased transparency and visibility into financial activities, leading to better risk management and compliance.

- Real-time access to accurate financial data, enabling decision-makers to make informed and timely decisions.

Research has shown that organizations that implement automation software and business process automation in their finance departments achieve significant improvements in their financial performance.

According toDiginomica, automation has enabled larger companies to close their books 15% faster than smaller organizations, despite having to deal with complex accounting issues, such as inter-company transactions and foreign currency exchange.

See how to manage operations with BPM

Making agile workflows work for you

Automation software and business process automation are essential tools for finance departments to improve their workflows. Organizations that invest in these technologies will reap significant benefits and gain a competitive edge in today's fast-paced business environment.

Overall, implementing automation in finance departments can lead to significant benefits, including improved accuracy, efficiency, and decision-making. As the business environment becomes increasingly complex and competitive, companies that embrace automation are more likely to succeed and thrive in the long run.

Key benefits of automation tools

- Increased accuracy and compliance

- Reduced errors and inefficiencies

- Faster processing times

- Improved supplier and employee satisfaction

- Better data analysis and decision-making capabilities

- Increased scalability and adaptability to changing business needs

- Cost savings in the long run, despite initial implementation costs