The lifeblood of a business is its cash flow, which means a successful organization is making sure dues are collected on time. But human error, inaccuracies, and delays can take down a company in the blink of an eye. Efficient invoicing, optimal days sales outstanding, and quick dispute resolution can all be accomplished through an automated workflow process.

The accounts receivable process helps verify your company’s financial health and serves as a way to analyze and measure a company’s liquidity.

Why Automate Your Accounts Receivables Process?

Traditional AR management involves manual invoicing, payment tracking, and reconciliation, which often leads to delays, inconsistencies, and cash flow disruptions. Automation eliminates these inefficiencies by:

So why should you bother automating your accounts receivable process?

Reduce human error and effort

With less human involvement, credit management, creating and sending invoices, and reconciliation become more accurate and efficient. Once automation starts ramping up, your finance department can focus on more value-adding tasks, such as decreasing debt, investing in innovation, and funding growth.

Unlock a predictable cash flow

Without automation, your anticipated cash flow might not even be close to what you’re actually collecting. By automating payment notifications, reminders, and emails to ensure collection on time, you’ll guarantee a consistent cash flow. Profits tied up in outstanding accounts receivable impact liquidity. But with an automated workflow, teams can track the status of each invoice and fully control the collections process.

Transparency yields better decision-making abilities

When every step can be tracked, team members at each stage gain control and autonomy, so strategic financial decisions can be reached faster. The ability to instantly access critical data, such as delivery status, amount owed, and payment due dates, means accurate cash forecasting and key insights on opportunities for improvement are just within reach.

Guaranteed security and compliance

Paper- and email-based AR processes are susceptible to data breaches, phishing attacks, fraudulent invoicing, and GDPR noncompliance. Automated accounts receivable sends 100% of your outbound invoices electronically, through a single provider. Ensure that compliance risk is minimized and required reporting is streamlined and automated with platforms like Qntrl.

How to implement an automated accounts receivables process successfully

Get your accounting department onboard

Your accounting department knows better than anyone else the ins and outs of your accounting workflows and the pain points your company is facing. Have the team get together to map out a system of your workflows to determine what needs to be streamlined and automated and what unnecessary steps you can remove to reduce payment friction and simplify billing.

Develop a collection plan

Ask your clients which day is the most convenient for them in terms of cash flow. Some customers might get billed bimonthly, some weekly. Consider these points when coming up with your business agreements for customers:

How does your business stand? If you need to get money back faster, payment terms should be shorter.

What are the industry standards? Do research on the billing practicing trends in your field.

Agree on a date and send all invoices electronically for proper documentation. This strategy streamlines your accounts receivable process flow.

Document your collection process

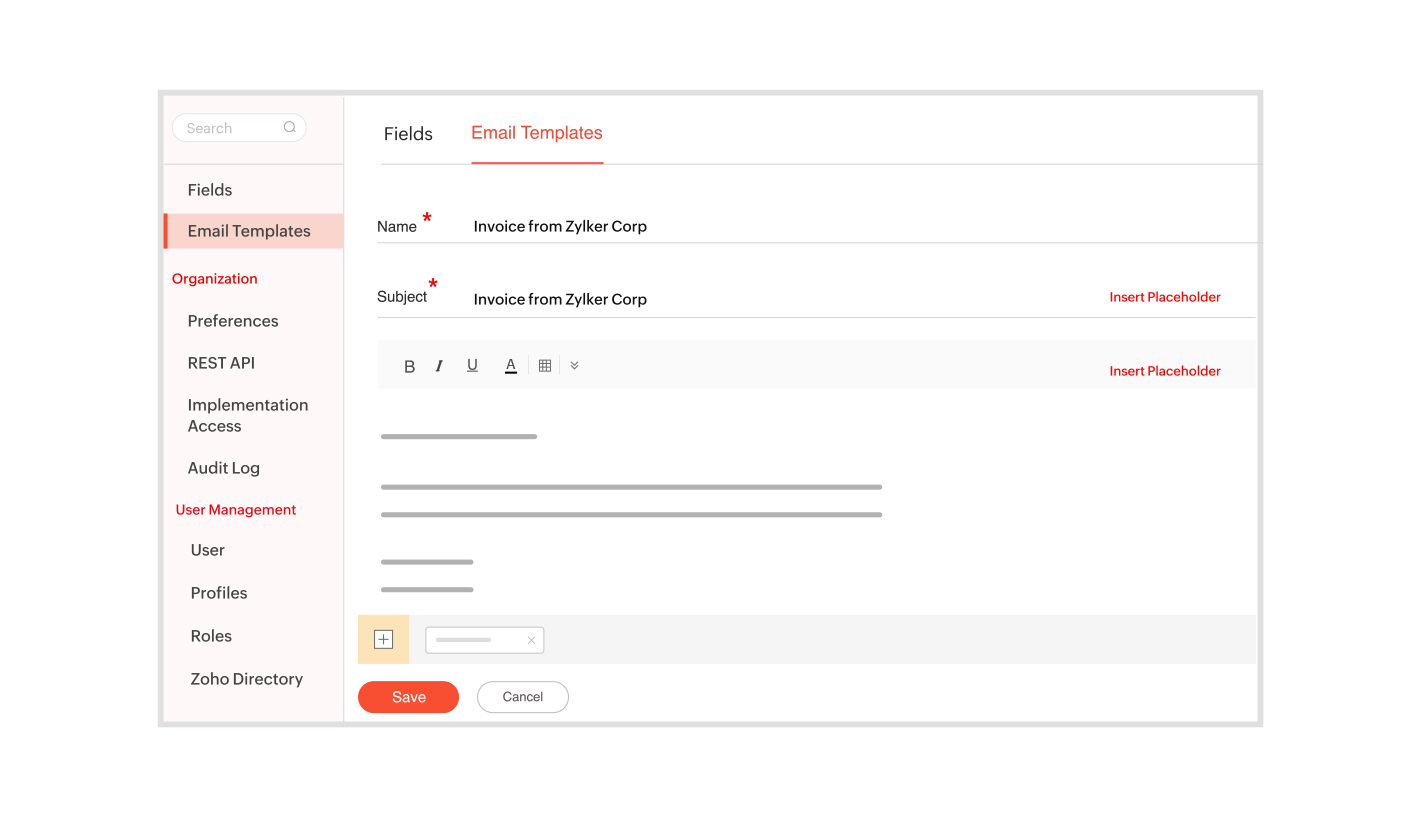

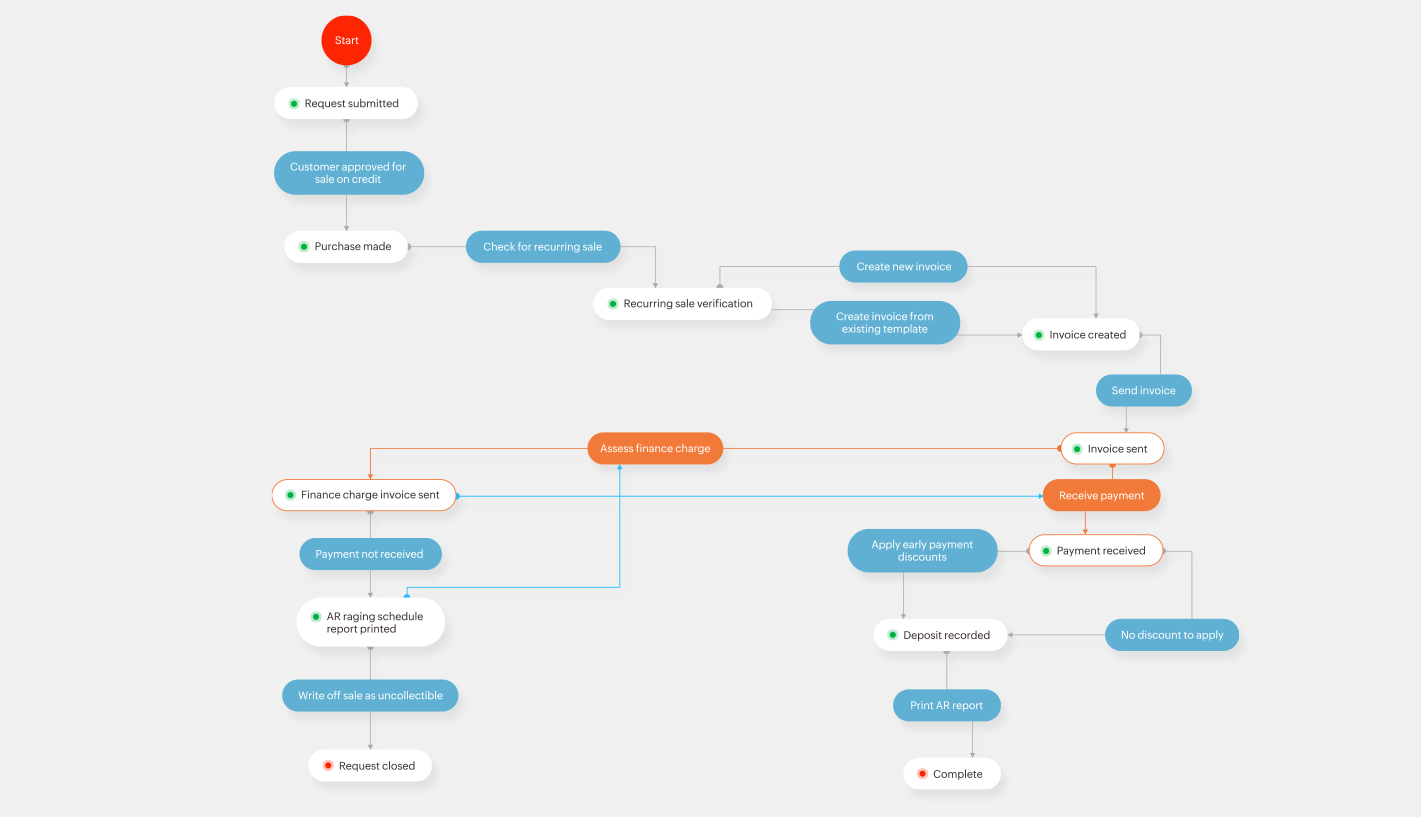

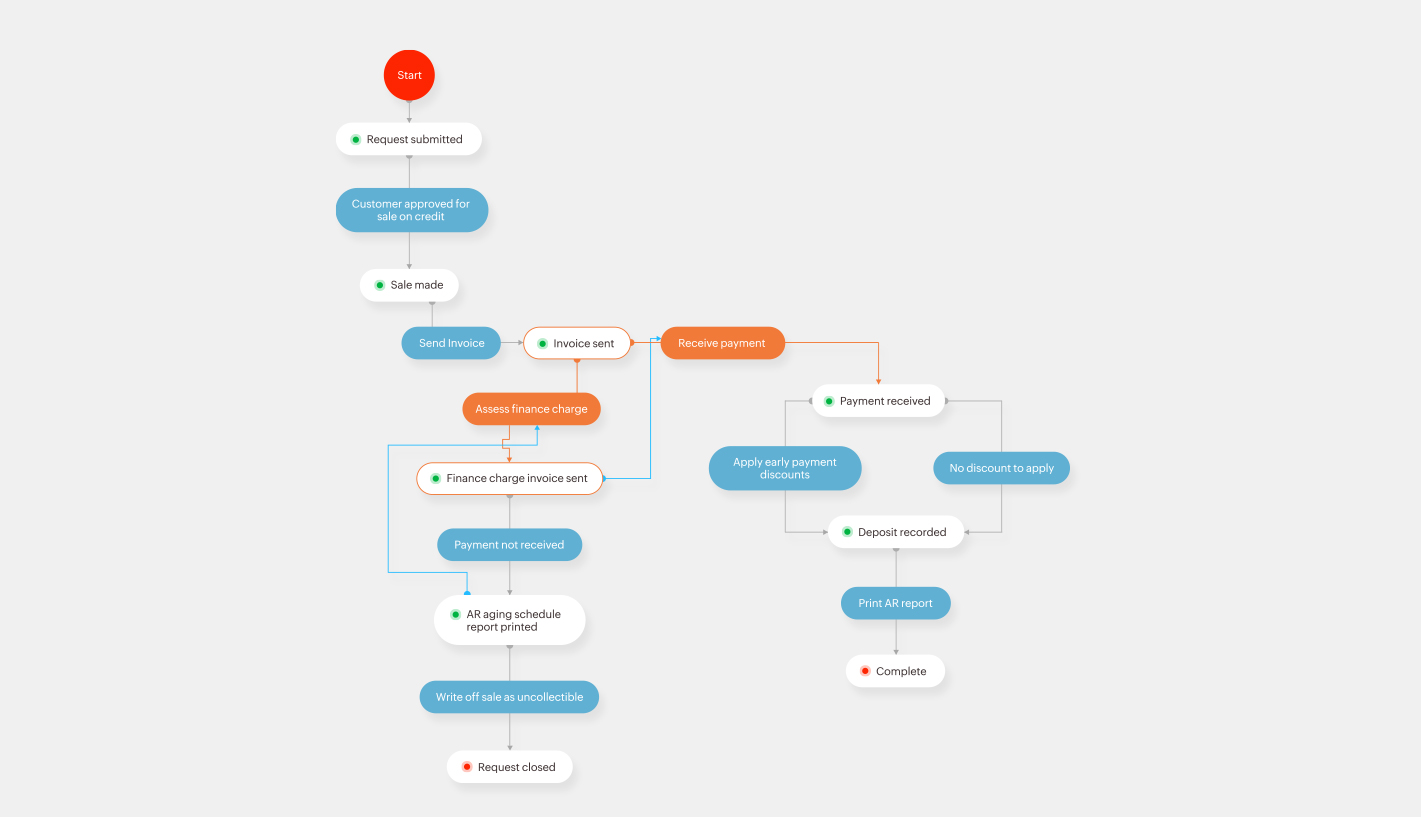

Now that you’ve locked down your collections plan, document your AR collections workflow. Visualizing your workflow with platforms like Qntrl helps teams reduce errors in billing, audit and optimize the collections process, and even onboard new employees more quickly.

Consider incentivizing advance payments

Establish payment conditions that include incentives for customers to pay early. While you’re at it, also set up conditions that include penalties for late payers. Can you offer incentives to customers who choose annual payment plans? This is something worth pondering when setting up your new workflow.

Build and maintain relationships with clients

Make sure your accounts receivable staff has excellent relationships with clients and maintains consistent contact with them. When you respect clients, they're more likely to remember to pay on time and to care enough to keep making those payments.

Set up a plan to secure those payments

Things come up and circumstances sometimes prevent payments from being made. Interrupted cash flow, low revenue, and even bankruptcy are things you should be ready to navigate.

Here are some steps to make sure you still get your payments in those scenarios:

- Reach out to your client to ask if they need more time

- Wait five business days before reaching back out

- Send a letter of demand

- Send a final letter of demand, if necessary

- Hand the case over to a debt collection agency

Set up a quick dispute resolution process

One of the most common causes for nonpayments is disputes. Monitor disputes, understand the reasons for them, and try to resolve them as soon as possible. Delayed resolutions just spiral into even more delays. Automating the dispute workflow makes refunds and chargeback management easy. Track and record chargebacks effortlessly to improve your customer experience.

In all cases, setting up payment expectations at the start of a new relationship is the best thing you can do for your business.

Choosing the Right AR Automation Software for Your Business

Not all automation tools are created equal. Look for a solution that offers:

- Customizable workflows for invoice approval and payment reminders

- Integration capabilities with your accounting software (e.g., QuickBooks, Zoho Books, SAP)

- Automated follow-ups for overdue invoices

- Real-time analytics to monitor AR performance

Qntrl helps streamline AR processes by providing end-to-end automation, ensuring every step—from invoicing to reconciliation—is seamless.

Optimizing and Scaling Your AR Automation Strategy

Automation isn’t a one-time setup—it requires ongoing refinement. Regularly analyze your AR process and:

- Identify areas for improvement (e.g., reducing invoice approval time)

- Update automation rules based on customer behavior trends

- Gather feedback from finance teams and customers

Optimizing automation ensures sustained efficiency and long-term financial stability.

Conclusion and Next Steps

Automating your AR process is more than just a convenience—it’s a strategic move toward financial efficiency and stability. By implementing structured automation with tools like Qntrl, businesses can eliminate manual errors, accelerate collections, and improve overall financial health.

Want to take control of your receivables? Explore how Qntrl can automate your AR process today.